BY Richard Summerfield

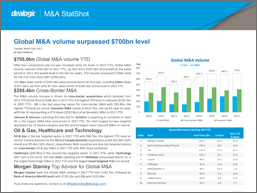

Global mergers & acquisitions activity has been on the up, according to Dealogic, with consecutive year-on-year increases for the last four years. And 2017 may prove to be even busier. There have been $705bn worth of deals announced in the year to date, marking the first time since the onset of the financial crisis that the $700bn mark had been surpassed in same YTD period.

One of the major forces driving activity has been firms pursuing cross-border deals. Such transactions reached $288.4bn in 2017 YTD, up from $144.9bn in 2012 and the highest YTD level since the $324.7bn recorded in 2007. The US accounted for $95.8bn worth of overseas acquisitions, the highest YTD level on record. The $31.4bn offer for Swiss biotech company Actelion by American healthcare group Johnson & Johnson is the largest announced deal o date.

From a sectoral perspective, the oil & gas industry saw the most activity, with a record $96.7bn worth of announced deals to date. Of this total, $52.4bn and $9.4bn occurred in the domestic sectors of the US and Canada respectively.

The second most targeted industry was the healthcare sector, with $95.9bn,and technology was third with $87.1bn.

Morgan Stanley topped the adviser rankings in the YTD. Though the firm’s share of total deals fell from 22.0 percent to 20.2 percent, it was involved in $142.7bn of deals, far outstripping Bank of America Merrill Lynch, which had an 18.5 percent share – up from 14.4 percent in 2016 – and a total deal value of $130.3bn. Citi Bank advised on 17.6 percent of transactions YTD, up from 13.2 percent in 2016 for a total value of $123.9bn. Goldman Sachs, which topped the global advisory rankings this time last year, suffered the most in the early part of 2017. Last year the firm advised on nearly a third of deals; this year, however, it fell to fourth place, with its share of deals nearly halved to 16.7 percent, having been engaged on $118.2bn of transactions in the YTD.

Report: Dealogic M&A StatShot